SEA: short for South East Asia.

Following the steps of China, Southeast Asia is building its own path to success in the flourishing e-commerce industry, due to its natural advantages as well as external financial support. With a rising internet penetration and a quite fragmented e-commerce market status, Southeast Asia finds itself as relatively virgin territory, chased by provident Chinese tech giants.

SEA Consumers: online-born shopping enthusiasts

Given the massive number of internet users, Southeast Asia unveils a huge potential to engage more and more consumers into e-commerce. By January 2018, Southeast Asia’s internet users ranked third worldwide, second only to East Asia (China, Japan, South Korea…etc.) and South Asia (India, Pakistan, Bangladesh…etc.). 2017’s “East Asia E-Commerce Report”, jointly released by Google and Temasek, predicted that the number of internet users in Southeast Asia will reach 480 million by 2020, making it the internet fastest-growing region in the world.

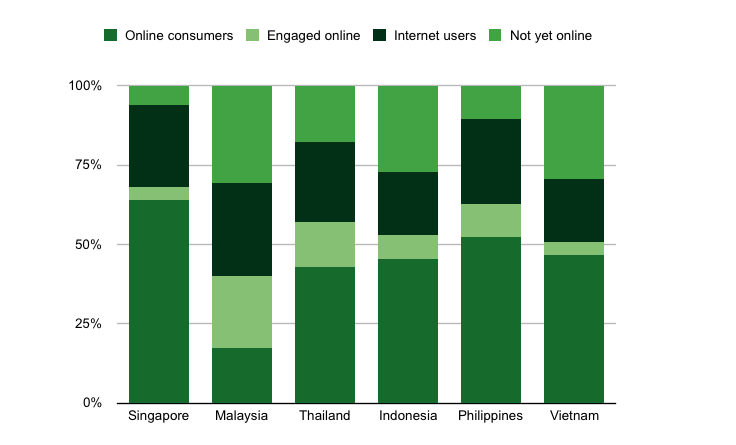

This rapid expansion of internet users has also driven a substantial growth of online shoppers. According to Hootsuite, over half of the internet users in Southeast Asia (excluding Malaysia) are already shopping online, or at least engaging in online consultation before purchasing. In already developed countries like Singapore, the penetration rate of online consumers nearly reaches 70 percent.

Apart from Singapore, where e-commerce is already relatively mature, in the other Southeast Asian countries the number of online consumers is growing at a double-digit rate annually. Furthermore, consumers from Southeast Asia are particularly prominent about time spent on the internet: they spend online an average of 3.6 hours per day, over one hour more than US, UK and Japan (which consumers respectively spend 2 hours, 1.8 hours and 1 hour).

Another factor contributing to the e-commerce boom in this region is that consumers are mostly relying on mobile devices to surf the net. In February 2018, 72 percent of the e-commerce traffic in Southeast Asia is generated on mobile devices. The most representative country is Indonesia, where mobile traffic takes up to 87 percent. Given the fact that mobile consumption is responsible of the majority of online sales in mature e-commerce environments, such as China (over 80% of online sales are generated from mobile devices), it is foreseeable that online consumption will increase explosively once people’s consumption capacity is improved.

Actually, a fast-growing economy is already a fact in this region: Southeast Asian consumers’ purchasing power has already been (and still is) growing exponentially. The World Economic Forum estimates that the region of Southeast Asia is projected to be the world’s fifth-largest economy by 2020. It already boasted a collective economy worth US$2.6 trillion, growing at an average rate of 5 percent.

The Huge Market Potential of SEA

Southeast Asia’s online retail is building up tremendous volumes, year after year. It seems that this situation could last for quite a while, especially because of the strong influence of Chinese tech giants. These companies are shifting their focus from their domestic fully developed market to Southeast Asia, by investing large amounts of money along with sharing their advanced technology and successful business models.

A Lot of Room for Online Retail Growth

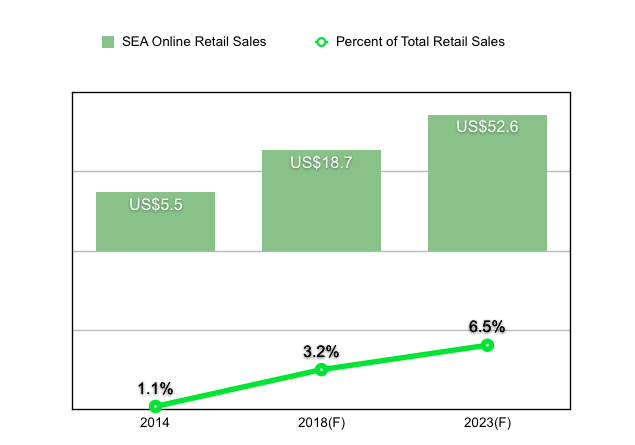

As mentioned above, the growth of Southeast Asia’s online retail sales is astonishing, and a slowdown is still far to occur. According to Forrester, the total online retail sales would hit US$ 53 billion in 2023, growing at a compound annual growth rate (CAGR) of 23 percent, up from 2018’s US$19 billion. However, even if developing at a relatively high growth rate, online retail takes up only 3.2 percent of the whole retail sales in 2018. This is only about one-fifth of China’s and America’s percentages, where this figure usually oscillates around 15 to 20 percent. For this reason, we can assume that there is a way larger potential room for growth out there for online businesses in Southeast Asia.

Among these Southeast Asian countries, Forrester estimated that the largest online retail market, Indonesia, would touch US$7.6 billion in 2018, accounting for 41% of the total online retail sales in the region. Following, Vietnam should have reached US$2.8 billion, while Thailand and Malaysia US$2.7 billion and US$ 2.2 billion respectively. The smallest e-commerce market, the Philippines, is expected to have the fastest growth rate in the near future, expanding at a CAGR of 30.4 percent between 2018 and 2023.

Chinese Tech Giants Investing in SEA: Game On

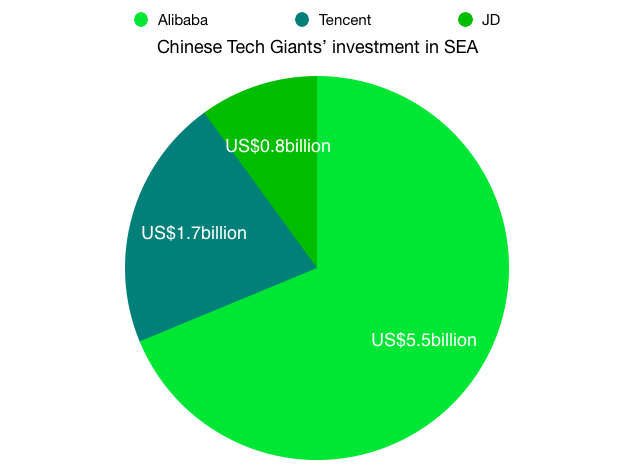

Chinese tech giants are harshly battling for a slice of the Southeast Asia’s e-commerce pie since 2015. By the end of 2018, Alibaba, JD.com, and Tencent combined invested more than US$8 billion in the region’s e-commerce, logistics, and payments markets.

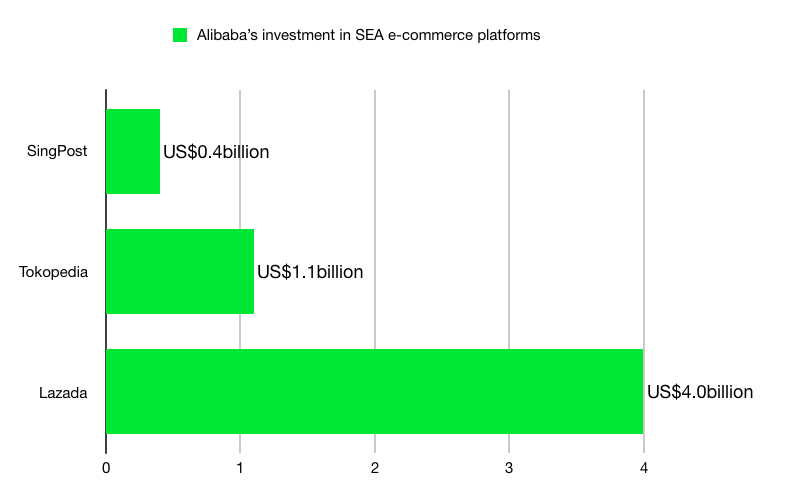

Alibaba secured its leading position in Southeast Asia by initially pouring US$1 billion in Lazada in April 2016 and then consolidated it by adding up another US$1 billion a year later, raising its shares from 51 percent to 83 percent. Subsequently, with a further US$2 billion investment in March 2018, they managed to turn Lazada into the largest e-commerce operator (in terms of average monthly visits) in Malaysia, Vietnam, Thailand, and the Philippines. But the Chinese e-commerce giant didn’t stop there. In August 2017 they invested US$1.1 billion in Indonesia’s C2C e-commerce startup Tokopedia, and later on in December 2018, together with SoftBank Vision Fund, added up another US$1.1 billion. Alibaba also got involved in Singapore e-commerce by investing US$398 million in Singapore Post (SingPost), gaining 10.35 percent of its stakes, as well as a 34 percent share in SingPost’s e-commerce logistics arm,

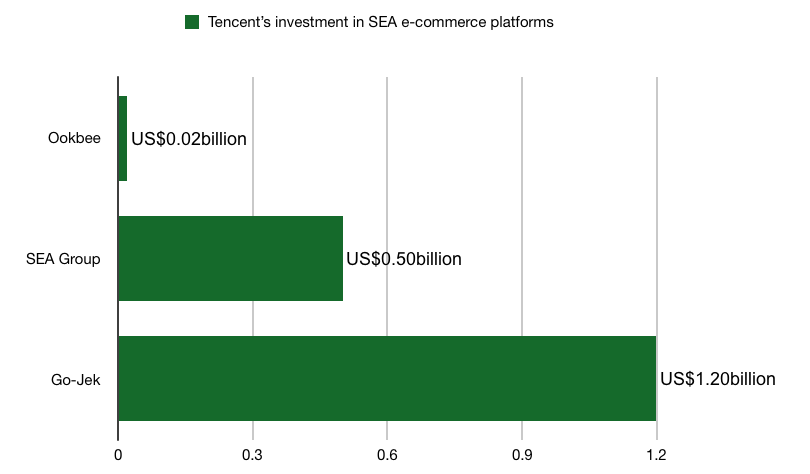

Tencent, albeit invested less than Alibaba, was not that far behind in this intense gameplay. By throwing US$500 million in Sea Group in May 2017, Tencent is now holding stakes of Lazada’s biggest competitor in Southeast Asia. The Chinese internet superpower also invested US$1.2 billion in the Indonesian ride-sharing app Go-Jek, which ever since had expanded its services by offering also payments and food delivery.

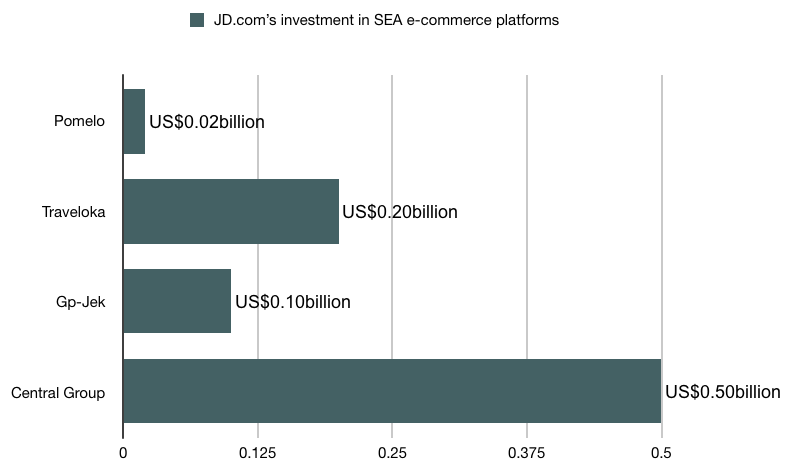

Although being the first mover, compared to Alibaba and Tencent JD.com seems a little less passionate about investing in Southeast Asia. So far their strategy consisted of investing lesser amounts in smaller markets and making dispersed and diversified moves to bring its superiority into full play. It launched its own local website in Indonesia in 2015 and its first “cashier-free” store in 2018. JD.com teamed up with Central Group and managed to dominate Thailand’s e-commerce market by establishing JD-Central Group in November 2017. JD.com also replicated its well-known logistics system to Thailand and Indonesia, rapidly accelerating the delivery efficiency in the region. In addition, its investments in the region include buying shares of the Vietnamese online retailer Tiki, Indonesian Go-Jek, and Thailand’s online fashion retailer Pomelo.

Key Takeaways:

- In SEA, a growing number of internet users are starting to shop online. They tend to spend more time online than their American, British or Japanese counterparts, mainly accessing the net from their mobile devices.

- Online retail sales in SEA are predicted to grow at a compound annual growth rate (CAGR) of 23 percent in the next five years. Indonesia, SEA’s biggest online retail market, accounts for 41 percent of online sales, meanwhile the Philippines, currently the smallest online market, will grow at the fastest pace.

- Chinese tech giants are battling to conquer SEA’s retail market. They are reshaping the e-commerce market by pouring huge amounts of funds in the region’s e-commerce, logistics and payment markets.