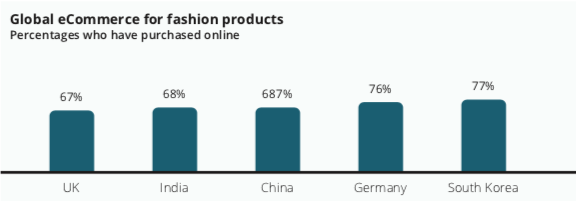

Among all the trends that are reshaping the worldwide fashion industry, eCommerce is surely among those having the biggest impact. Geographically, each region has been affected differently (according to wealth and digitalization levels) but in general, eCommerce has always been a factor that prompted industry expansion. However, eCommerce is not always a bowl of cherries: besides the many opportunities, a few threats are hiding behind the corner. Following, a brief but effective analysis of the impact of eCommerce on Fashion and its main segments, as well as trending strategies to bear the fruits of this opportunity and avoid missteps.

Fashion Ecommerce: An Overview

China accounts for alomst half of the global market

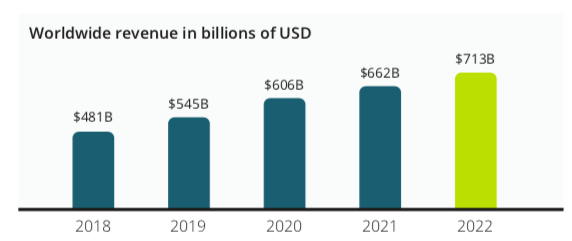

The eCommerce fashion industry has a global market value of US$480,912m in 2018 and an expected annual growth rate (CAGR 2018-2022) of 10.3% resulting in an expected market volume of US$712,517m in 2022.

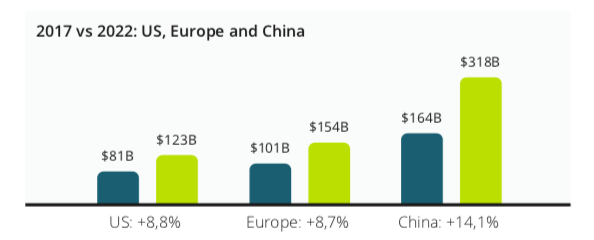

From a global comparison perspective, it is shown that most revenue is generated in China which accounts for almost half of the global market. This is due to the saturation of traditional western markets while China is going to be the real thruster of the fashion industry growth. Between 2017 and 2022, as shown below, the CAGR are expected to settle at: 8.8% in the US, 8.7% in EU and 14.1% in China.

The above numbers describe Fashion eCommerce as a florid and dynamic industry. This success is mainly fueled by 4 interesting drivers; however there are also 4 threats that need to be considered closely to make sure this huge opportunity is caught.

CLOTING & APPAREL

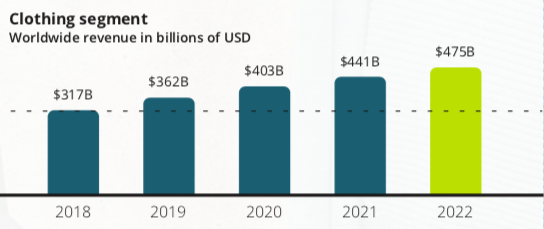

As fashion’s largest and most representative sector, clothing and apparel acts as the locomotive of the whole fashion industry. Naturally this applies to eCommerce too.

Lower digital barriers to entry for all clothing merchants offer the opportunity to market, sell, and fulfil orders globally and automatically. As a result, worldwide revenue is projected to grow in absolute terms from around $317 billion in 2018 to$475 billion in 2022.

The same trend also affects the revenue per user (ARPU) that will grow from $270 in 2018 to $301 in 2022, highlighting an increasing incidence of eCommerce purchases in the fashion industry.

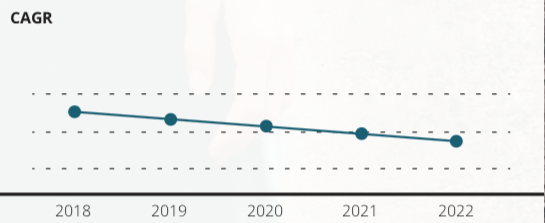

On the other hand, although absolute numbers are steadily increasing, the worldwide fashion industry is on a way of stabilization, as grow rates are expected to slow down: after 2021 the CAGR will not be 2-digits anymore.

FOOTWEAR

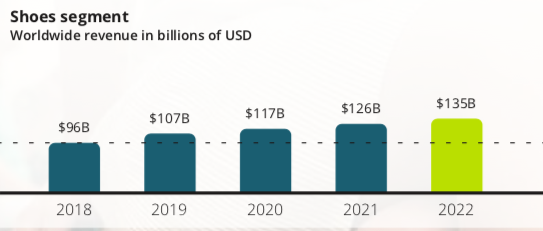

As the second biggest segment ofeCommerce fashion, footwear willincrease, in absolute market size, from $96 billion in 2018 to $135 billion in 2022.

However, as well as the apparel sector,the worldwide footwear segment willdisplay pattern of shrinking growth year-over-year. From double digits in 2017-2019(+13.6% and 10.8% respectively) footwear is expected to grow a mere +6.6% in 2022.

BAGS & ACCESSORIES

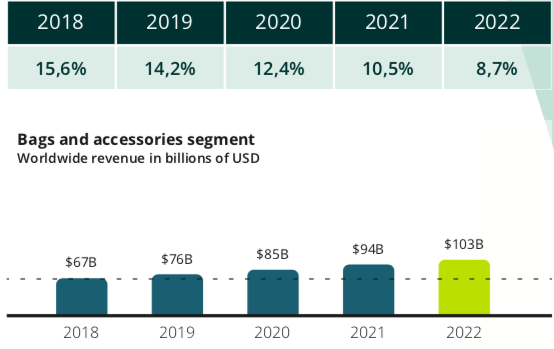

Bags and accessories represents the healthiest segment of eCommerce fashion, despite its absolute numbers being the smallest. This segment is growing at a stronger rate; it will likewise see its double-digit growth dip into the single digits only by 2022.

Trending Strategies

The above data points offer a wealth of growth opportunities for fashion retailers worldwide. Below are some of the most trending strategies that can help companies develop long-term eCommerce plans. Basically these strategies can be read as an application of the industry trends (mentioned in the previous chapter) to the online market.

PERSONALIZATION

Personalization is a game-changer trend, since it places the “scepter of power” in the hands of customers.

According to data presented by Nosto, personalization is a leading factor also in eCommerce at large:

By tracking user behavior fashion sellers can build a product presentation personalization (Netflix-like) into the onsite experience. Although this may start with recommended products – if you watched or bought this, you might like to watch or buy that – true personalization extends to the very visuals that are used to present products themselves. Moving into the future, shoppers will begin to expect the same kind of personalization in the eCommerce fashion industry. For instance, visitors who have either browsed or bought women’s shoes should have a homepage experience catered to that history.

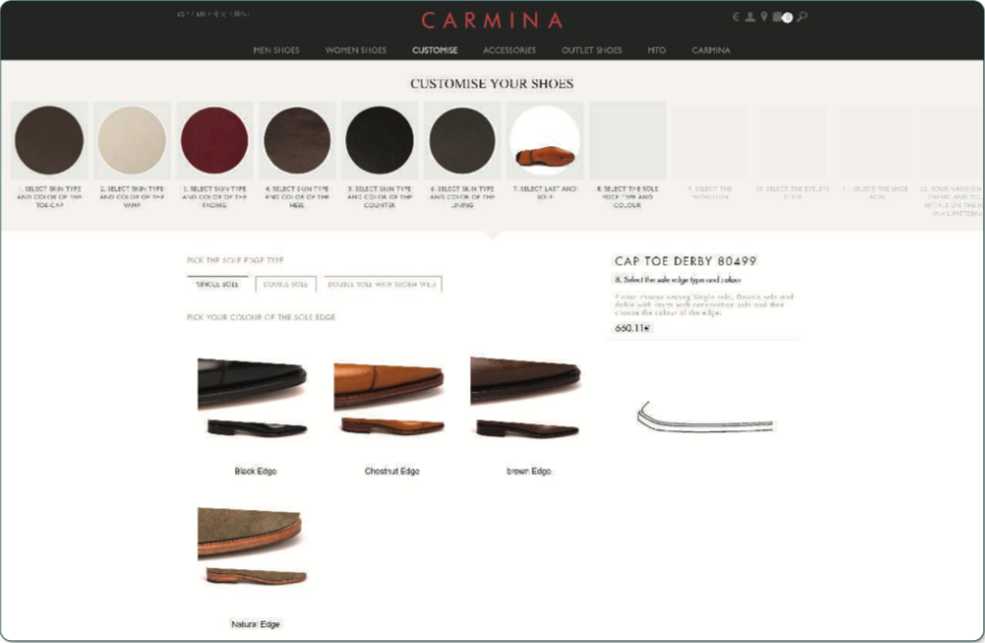

Another side of personalization, more bound to technology than data insights, is final product self-customization. Which means allowing customers to design product as they want it to be. Besides sparking creativity, it’s fun and gives the customer a proactive shopping experience.

Carmina uses a built-in static self-customization feature, allowing worldwide (including Chinese) customers to personalize step by step their shoes, by choosing model and

Personalization is causing a seismic shift across the landscape of consumer-facing brands, and we are only starting to feel the shocks. Brands that create personalized experiences, by integrating advanced digital technologies with customers data, are seeing revenue increase by 6% to 10%, according to BCG (Boston Consulting Group) —two to three times faster than those that don’t. As a result, personalization leaders stand to capture a disproportionate share of category profits in the new age of individualized brands while slow movers will lose customers, share, and profits.

SOCIAL MEDIA

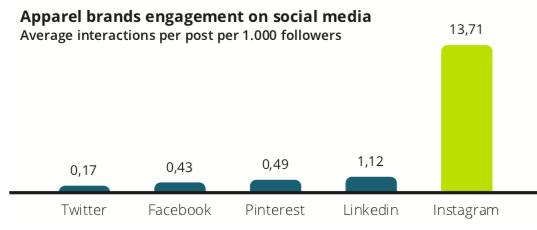

Social media are a great tool to promote fashion brands and products, due to their broad use and reach.

Social media can also be successfully leveraged within the online store itself. Beyond simple links to social media pages and social media logins – facilitating users to quickly sign up and login into an eCommerce website – social media are also influencing websites’ styles. Indeed, some websites are now presenting entire“Instagram-like” sections to attract customers with appealing pictures.

However, the real power for social media comes from integrating multiple channels to create

FLASH SALES

Flash sales are no longer a simplistic method of unloading out-of-season inventory. Instead, as long as they’re combined with exclusivity and anticipation, they’re becoming eCommerce fashion royalty activities. In general, apparel, accessories, and shoes lead the way in the flashiest and most profitable shopping days of the year: Singles Day (11/11) in China and BlackFriday in Europe and America.

How do you maintain brand integrity and still leverage big sales?

One of the ways to do this is by making flash sales members-only, “velvet rope” experiences for selected group of customers. Talbots, Sephora, Evy’s Tree, and Kylie Cosmetics do this regularly through exclusive collections and early access to social media fans and loyalty program members.

Another way is to merge flash sales with product drops. Frankies Bikinis, for instance, regularly sells out new products in a matter of minutes. Even better, their product drops generate over six figures in sales within the first hour of launch. The downside is that monthly launches and regular flash sales are labour intensive.

TECHNOLOGICAL INNOVATION

Augmented reality, virtual reality, wearable tech, and connected fitting rooms are all making big waves in online fashion. But currently, in the war on returns, two innovations are still predominant: online sizing and online search.

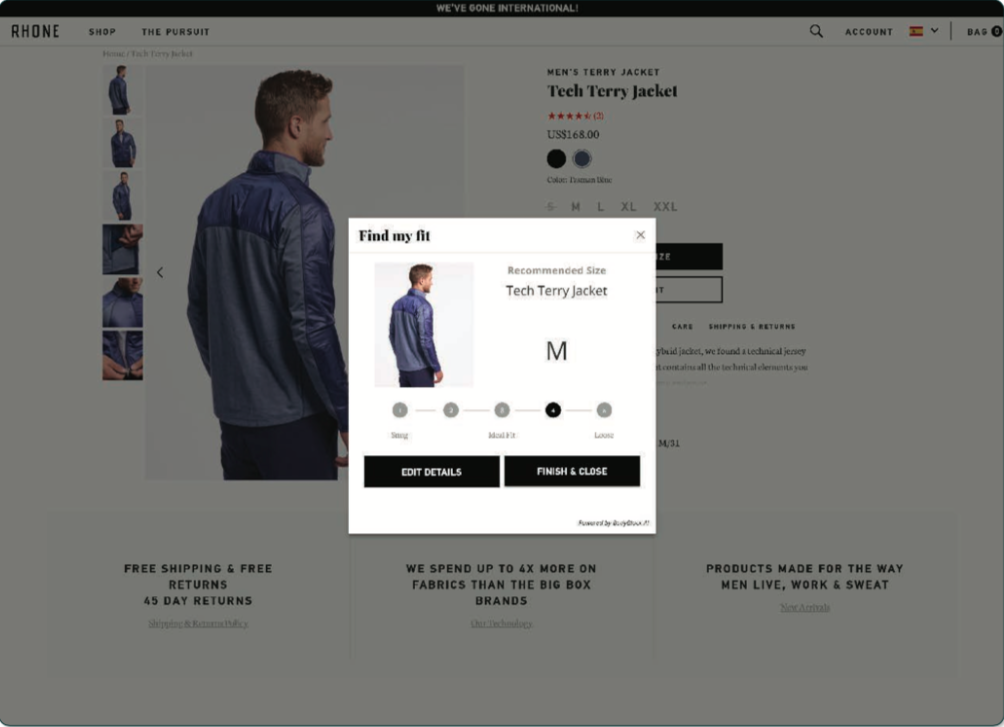

Online Sizing

Online sizing is the closest virtual substitute of physically “trying on” clothes and shoes. These kind of systems are especially great to lower return rates (and lower return management costs). Rhone Apparel for example implemented FitsMe’s “Fit Origin” sizing system and within the first month, raise their conversion rates from 3.7% to 9.8%. Those number held even after the solution had been in place for over a year and analytics show that Fit Origin has delivered an impressive +20.4% in incremental revenue to Rhone’s website.

Online Search

Perhaps the simplest form of artificial intelligence and machine learning revolves around onsite search. A predictive autocomplete system, not only saves shoppers time

Voice-powered AI search can help to make recommendations based on a user’s past purchase history and online behaviour as well as enable voice-activated purchases within an app or augmented reality.

THINK GLOBALLY

Among the 10 largest e-commerce markets in the world, Asian countries take up three seats, leading by China, whose market share comes up to $672billion. Fashion-related products (as reflected in rising purchase rates) are among the most in demand.

The irony is that going global actually means getting local. Asian markets, and especially the Chinese market, are very different from American and European ones. Trends, players, regulations, habits, tools and customer tastes are radically different. Meaning that, even if a tech-driven globalization offers the means to sell globally while not being physically present locally, the ecosystem in which the business has to operate needs to be studied very carefully. The right term to describe these circumstances is“glocalization”.

Key Takeaway

Fashion brands around the world should look at eCommerce as their main sales tool.